This mini-report based on multiple-case studies on companies of different industries and sizes shall provide some insights on the chosen approach. As the interviews of the case studies progressed it became apparent, that the report can also provide insight into how the perception of the crisis has shifted within a few weeks.

Introduction

Every crisis is different, but some of the common best-practice responses are the same. However, the impact of covid-19 on supply chain management has been anything but astonishing positively and negatively, although a serious pandemic was expected since its first reporting in late Dec 2019. This mini-report based on multiple-case studies on companies of different industries and sizes shall provide some insights on the chosen approach. As the interviews of the case studies progressed it became apparent, that the report can also provide insight into how the perception of the crisis has shifted within a few weeks.

Supply chain management (SCM) is a quartet comprising business processes, staff executing the business processes, the data that is required to do so, and the systems leveraged for planning and execution support. In this context, end-to-end SCM covers the flows of information, physical goods, and cash from the customer (and occasionally end-consumer) via the internal production assets to the suppliers (and occasionally suppliers further upstream).

When business as usual is interrupted, supply chain crisis management kicks in with best practice responses:

- Prioritize the tasks at hand,

- Gain visibility and

- Manage the crisis with the available resources considering potential trajectories of the crisis.

While a serious pandemic was expected to occur, the response to it has been patchy across manufacturing companies. In the cases presented here, all companies are somewhat managing the situation well. It should be noted that this could be due to a self-selection bias. Representatives only participate if the company they work for is managing the response to covid-19 rather well. Exemplary reasons are that i) a company that has failed to respond in time, is unable to free up time for the interview, or ii) for reputational reasons, participants excuse themselves as unavailable.

Report setup

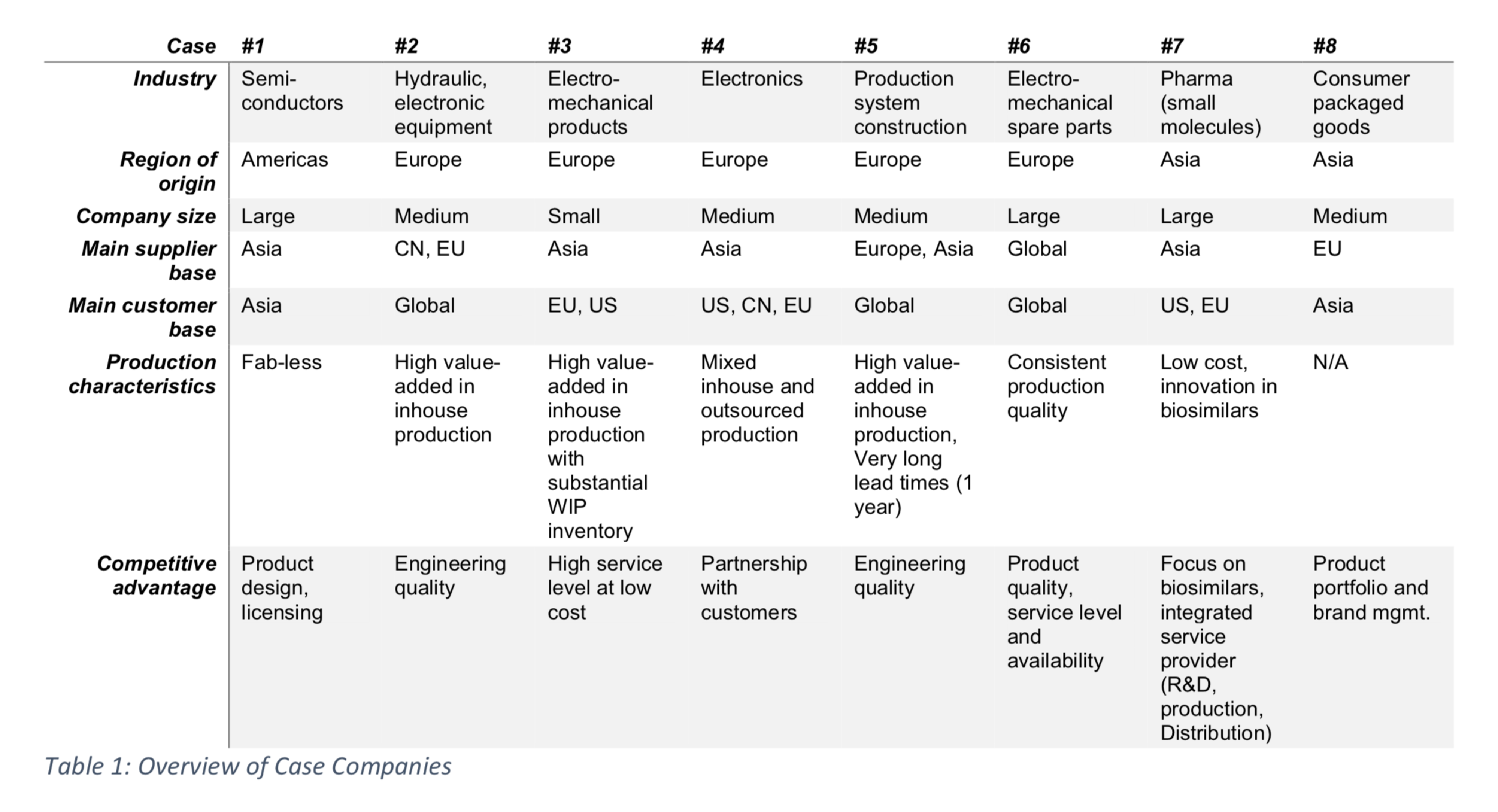

Most case companies are involved in the production, warehousing, and transportation (i.e. logistics) of physical goods, with one having no in-house production. The cases are numbered in chronological sequence of the interview. So, case #1 was the first to be interviewed, case #8 the last.

The case interviews with participating companies were structured with 3 introductory questions (see appendix) which were amended by non-standardized follow up questions to cover additional details of the participant’s response.

Encountered challenges

The challenges the participating companies encounter can be grouped (in descending priority) to:

- Logistics

- Demand

- Production,

- mental health, and external suppliers

- Customer and supplier relationship management

- Government regulations

The core challenges for the participating companies are posed by logistics in terms of with inflated freight rates, reduced freight capacities and uncertainties around customs procedures or clearing times. The main reason for high freight rates was the need for airfreight to catch up on supply delays (in particular, from locked down countries) towards customers, and the reduced availability of belly freight, i.e. cargo transport via passenger aircraft, due to reduced passenger air travel. Although changes of customs procedures and clearing times were named frequently, these were mainly concerns because cross border traffic was generally flowing.

Demand was – with exceptions – for most companies not an immediate concern. In few cases was a significant drop in demand observed, and only one company reported that customers actually walked away. For the demand that persisted, for distant customers, the mode of transport air was substituted for the usual MOT sea to make up for delays in supply and production. One company, with long order fulfillment lead time saw concerns more on the sales cycle, in that new orders were not coming in. However, in this case, the effect would only be visible in Q2 2021.

Another challenge was the risk of losing production capability in case staff falls sick. The need for physical presence (as opposed to office staff) at the production line and the proximity of manufacturing operations required changes. In extension for many participants, the emotional stress of their production staff was a concern as well. This ranged from concerns about job security, care for family members and the availability of commuting to the workplace. Suppliers in locked down countries/ provinces, posed supply risk as well. Because most case companies relied on sea freight as default transportation mode, the switch to airfreight promised some relief. However, because of the importance of Chinese suppliers, to use but one example, with the simultaneous collapse in air traffic, this quickly translated in logistics challenges. Thus, supplier shutdowns themselves have not been received as major issues but are instead seen as a logistics challenge.

Customer relationship management (CRM) and supplier relationship management (SRM) saw only indirect challenges from other challenges or the mitigation approaches.

Although not frequently spelled out, there was considerable concern to comply with government regulations. However, in general, the underlying assumption was always, that these requirements can be met while business challenges pose much higher risk.

Mitigation Approaches

The participating case companies had a very diverse set of mitigation approaches with only few commonalities.

- Dedicated covid-19 task force for visibility and prioritization

- Cash flow preservation

- High internal value-add with raw material inventories

- Long lead times on demand and supply side

- Shift introduction to split production staff along production steps

Only one company had set up a dedicated covid-19 task force, recruited from daily operations, to provide visibility of demand trajectories and supply availability. This was however triggered rather early and is beneficial because of the size and complexity of the business. However, without this visibility, the case company would face more severe challenges. Other case companies had their task force either setup informally as part of the business continuity plans or relied on senior management teams like S&OP meetings.

Cash flow preservation through reduced working hours and order screening was another approach. Case companies implemented reduced working hours where government support schemes were available. For customer orders with contractual penalties, these were evaluated individually whether the inflated transportation costs were exceeding the penalties involved. Likewise, when shipments had to be made, management had to sign-off to ensure the transportation costs are justifiable.

For the case companies with high internal value-add content the depth of production and engineering expertise enabled them to focus on building raw material buffers and allows the easier identification of alternative suppliers (sourced materials are standard components or steel alloys). The raw material buffers had generally higher days of coverage before the crisis struck due to reduced shipping frequency. Likewise, the high value add allows selective pre-production to reduce customer order fulfillment lead time later.

Likewise, whenever available, long lead times provide some insulation to the expected short-term swings. In case of long customer order fulfillment lead times, the expectation is that the shortfall of current sales will be made up by the time this would become visible and the flexibility in production allows pre-production. Likewise, long transportation times, mean that multiple shipments are on route from the suppliers which will to some degree help to balance out the current fluctuations.

To ensure production capability, all companies had put in place a shift plan to split production staff along production step, and similarly warehouse staff. The reasoning being that in case of an individual infection, at least one shift can continue to produce (although changes to the operated production steps being operated are implied), until hopefully the majority of the shift with an infection is cleared to return to work. These shift patterns were setup considering personal circumstances as much as possible. In multiple cases this was additionally supplemented with psychological support.

Summary and Conclusions

The supply chain challenges posed by covid-19 are primarily in the areas of logistics and demand. Nevertheless, in particular logistics challenges are a compounding of the other factors as many companies (not just the case companies) were trying to make up for either delayed replenishments or delayed shipments to customers. An impact on customer or supplier relationship management was noticeably absent, which could be a temporary effect.

To mitigate the impacts of these challenges, the main objective was to gain visibility, whether by task force or existing meetings, not least to preserve cash flow. Cash flow will continue to influence the evaluation of available options. On the other hand, existing production characteristics like high inhouse value add and long customer lead times are beneficial because they provide flexibility, however these would not be part of a deliberate strategy. In addition, production capabilities are effectively insured by splitting the production staff

If senior executives missed the first opportunity to mitigate challenges, they must start immediately evaluating what the potential trajectories for their companies are and which initiatives they can trigger. Conserve cash flow now and opt for margin maximization through cost reduction and customer prioritization later. However, it remains to be seen whether companies would kick-off their improvement initiatives once the recovery starts. The experience of the financial crisis of 2008 indicates that some assume the recovery will be short lived and they missed out on opportunities later. Talking with an external partner, not vested into the previous decisions and able to provide quick insights may be the best option to start the internal discussion.

Acknowledgements

This report would not have been possible without the time and openness of the interview partners. Thank you very much.

Appendix:

Introductory Questions for Participants:

- What are the 2-3 main questions that your company has at this moment related to supply chain to be able to adapt to the demand and supply fluctuations?

- Have you already set up a war room to prepare analyses?

- What are the most important operational questions the war room (or alternatively the supply chain team) is addressing?